CASE STUDY

Connecting the Black & Brown Entrepreneurial System in Milwaukee

DC Design utilized our research, strategy, and design services to identify the pain points experienced by Black and brown small business entrepreneurs and the institutions that serve them. Utilizing this information, we designed a solution to improve access to capital for minority small businesses in Milwaukee.

Social System: Wealth Creation

Client type: Foundation

Deliverable: Prototyping and Development of a Digital Platform

THE PROBLEM

Lending to minority small business owners is fraught with a historic legacy of redlining and racial bias.

There has been a racial wealth gap between Black and brown small business owners and other entrepreneurs. The historical lack of access to financial institutions and capital has led to a climate of discouragement amongst minority borrowers, not applying for credit or financing due to the belief they would be turned down.

THE PROJECT BRIEF

How might financial institutions support minority small business owners to thrive?

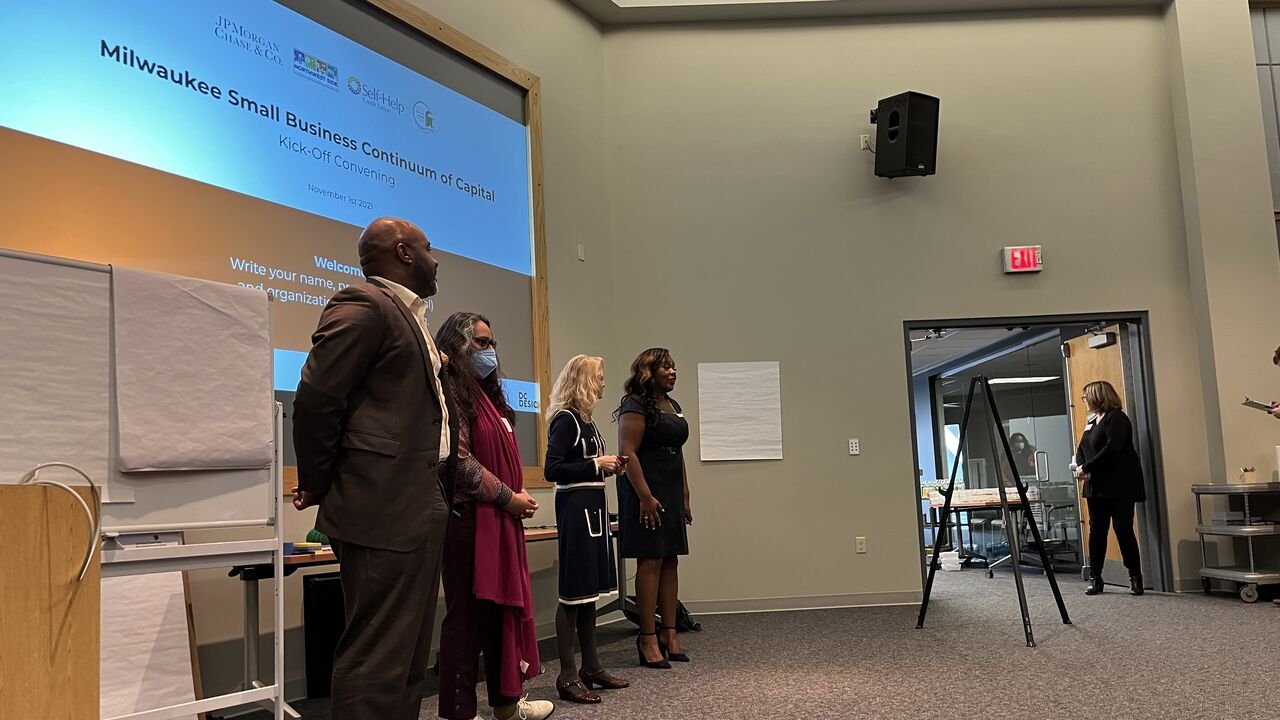

Three Milwaukee-based community development financial institutions (CDFIs)–Self-Help Federal Credit Union, Northwest Side CDC, and the Wisconsin Women’s Business Initiative Corporation–founded the Milwaukee Small Business Continuum of Capital (MSBCC) to address systemic inequities faced by minority small business owners. MSBCC hired DC Design to lead efforts in convening the collaborative, identifying the pain points experienced by Black and brown small business entrepreneurs and the institutions that serve them, and designing a solution that addresses those pain points and works to improve access to capital for minority small businesses in Milwaukee.

OUR APPROACH

Community research, engaging local Black and brown small business entrepreneurs

DC Design led community research, engaging local Black and brown small business entrepreneurs to learn about their needs, aspirations and experiences in building a business and seeking support from financial institutions. We also engaged with local CDFIs and banks to identify opportunities and needs in the Milwaukee entrepreneurial ecosystem.

Through this work, we captured how this variance in perceptions between entrepreneurs’ needs and financial institutions offerings created and exacerbated pain points, leaving numerous gaps in the operational processes of service providers and Black and brown entrepreneurs’ awareness of and trust in services available in Milwaukee.

THE RESULTS

DC Design created MKE BOSS (Milwaukee Build, Operate, Sustain, and Scale) a digital platform with two primary functions: One, it empowers entrepreneurs to find and engage with services that match their or their business’s specific needs and will help Build, Operate, Sustain, and Scale their business. Two, it allows service providers to showcase their services to entrepreneurs in the entrepreneur tool, receive and track client leads, manage client relationships, and send and receive referrals.

This functionality increases awareness, transparency, and consistent communication across the entrepreneurial ecosystem regardless of role or goal.

Testing done during research, design, and development has been remarkably positive, with entrepreneur and service provider participants calling the platform “powerful,” “clean,” and “easy to use.”

Additionally, the BOSS platform has inspired interest in additional pilots from outside entrepreneur-focused programs and financial institution branches in other states as they recognize similar challenges as those experienced by Milwaukee entrepreneurs and service providers.

View the MKE BOSS platform here: https://www.mkeboss.org/about-us

LEARN MORE

Social problems are complex. They cannot be solved overnight. Our clients come from different backgrounds and are focused on confronting a diverse range of issues, but one thing that unifies them is the decision they’ve made to reach for outcomes that are better than “good enough.”

Interested in working with us or just have a question? Get in touch